Back in the winter of 2021, based on a LinkedIn recommendation from Nikhil Kamath, co-founder of Zerodha, I picked up this wonderful book “Psychology of Money” by Morgan Housel. Until this time, no matter of self-reading or gyaan (words of wisdom) from others would inspire me to seriously look into financial investments and the joys of compounding. I had always been curious about Psychology in general, and now I wanted to know about Money and the psychology around it. And boy, did it deliver!

There were two important takeaways for me from this book. First, the power of humility – Acknowledge the fact that we have been “lucky” to get where we are today. And second most important was the power of Index funds – A low expense, passive fund, tracking the stock indices. I got inspired and embarrassed at the same time when I learnt how investing into this simple instrument could compound our money. I realized I had missed out on decades of compounding by now. No fancy fund managers required, pick a relatively low expense index fund tracking the index (Nifty or Sensex in India). A perfect gateway into the world of equity investment. The index funds invest in the top companies that form the cream de Le cream of the given economy. So, in essence, we are betting on the country and its potential to grow up and onwards from the current phase. The risk then is the collective stability and growth aspects of the economy.

The “Index funds” has been rightly listed by Tim Harford as one of the “Fifty inventions that shaped the modern economy” in his same titled book. (Brilliant book, I highly recommend everyone to read this masterpiece, it talks about history and circumstances around major inventions that have boosted the economy, most of which we overlook & take it for granted in our day-to-day life). The story of index funds takes us back to 1884. An excerpt from the Chapter.45 Index Funds of this book:

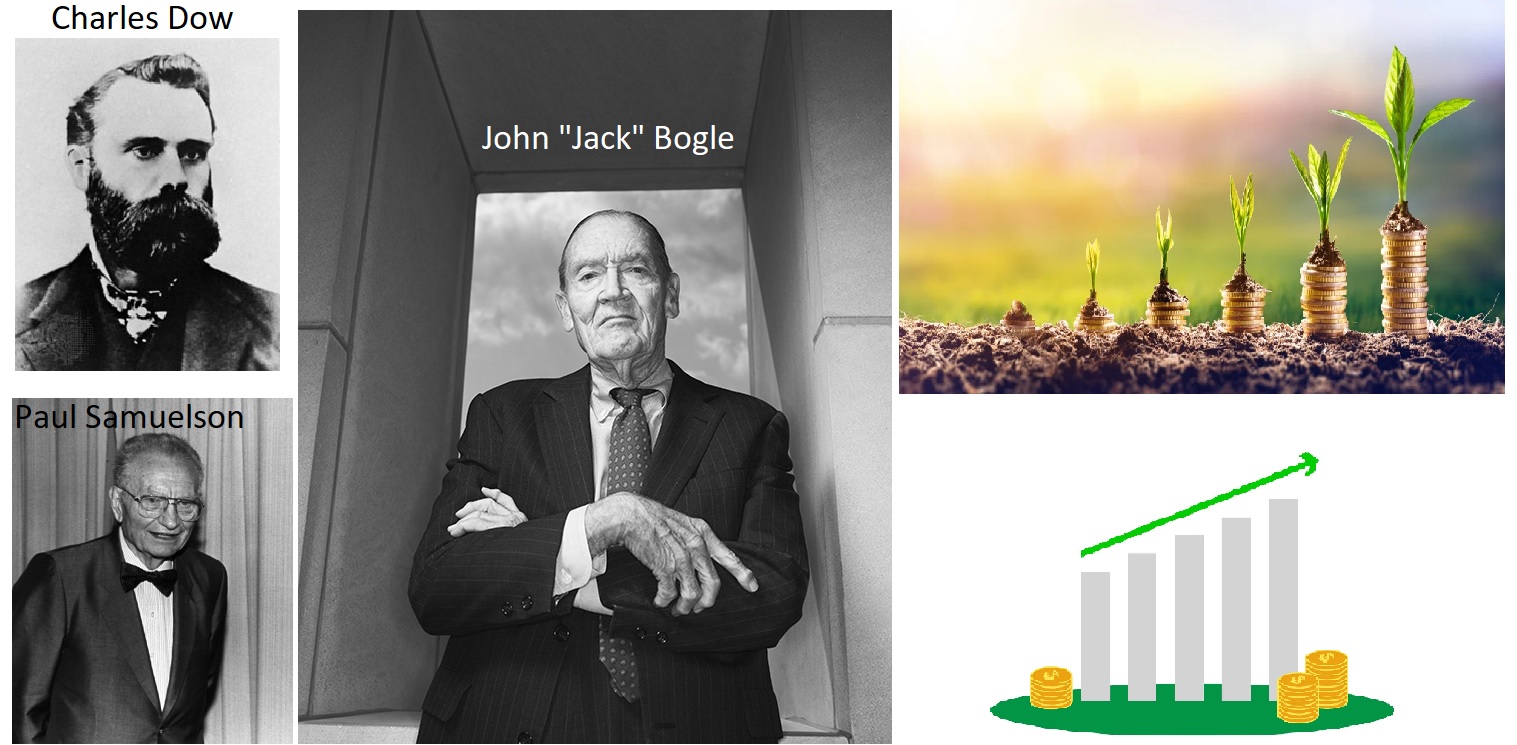

Before you can have an index fund, you need an index. In 1884, a financial journalist named Charles Dow had the bright idea that he could take the price of some famous company stocks and average them, then publish the average going up and down. He ended up founding not only the Dow Jones company, but also The Wall Street Journal.

Brilliant invention indeed. Now we could talk about the markets going up and down. More indices followed around the world, and the index would go on to indicate the current “health” of its economy. And then, one renowned economist Paul Samuelson, took interest in the power of index, the year was 1974. The winner of the first Nobel memorial prize in economics, published an article titled “Challenge to Judgement“, where he laid down the statistics based on the data available and highlighted that no professional investors were beating the market. He hoped someone could setup an index fund and open up the equity investment for the ordinary people, without having to pay ridiculous fees for meager returns.

Now, theory is one thing. To put it into practice is something else. It required the sheer will and determination of a businessman Jack Bogle to bring these funds alive. He had just started a company, Vanguard, whose mission was to provide simple mutual funds for ordinary investors. The simplicity of the index funds based on the thorough research and data from the world’s most respected economist propelled him to launch the world’s first index fund, in August 1976. Although the fund was a failure during its early days, Bogle held immense faith on the power and simplicity of the Index funds. Slowly but surely, the investors caught on. Forty years after Bogle launched his index fund, fully 40 percent of US stock market funds were passive trackers rather than active stock-pickers. Four to five decades on, this brilliant invention now saved ordinary investors literally trillions of dollars. Now that’s social service in its truest sense!

Samuelson, at an age of 90, gave a speech in 2005, where he credited Jack Bogle for this wonderful invention. He said “I rank this Bogle invention along with the invention of the wheel, the alphabet, Gutenberg printing, and wine and cheese: a mutual fund that never made Bogle rich but elevated the long-term returns of the mutual-fund owners. Something new under the sun“. What a “rich” legacy, this is philanthropy at its best.

Discover more from Keep it simple, stupid.

Subscribe to get the latest posts sent to your email.